With over 20 years of experience in the Vietnamese elevator industry, I have always believed that this sector has great potential and significant room for growth. However, upon reflection, the manner and extent of this development pose significant challenges. Why is that?

To address this question, let’s briefly overview the global and Vietnamese elevator industry landscape.

It can be said that the elevator sector is among the slowest in adapting to the current era of Industry 4.0. The technology, management models, and business strategies of elevator companies remain largely unchanged and similar to those of 20 years ago.

As a result, competition among companies seems to rely solely on one strategy: price. This fierce price war has led companies into a race for meager profits. Research costs are not allocated to enhance customer safety but rather to make users more dependent, extracting more from them during the usage process.

The COVID pandemic, followed by the Russia-Ukraine conflict, and the real estate crisis in China— the largest market for all elevator manufacturers— have become tightening nooses, trapping elevator businesses in stagnation.

The real estate crisis in China has a significant impact on elevator companies worldwide.

This is the international situation and context. What about Vietnam? While trends and situations have evolved, our mindset and habits remain very traditional.

Vietnamese still believe that elevator companies produce everything, and they remain passionate about areas like the G7, Europe, Thailand, Malaysia, where they have placed their trust for so long. However, in this era of globalization, who would be foolish enough to manufacture in such costly places? Labor costs, land costs, transportation expenses…

We may not realize that the majority of elevator components such as rails, cables, traction machines are manufactured in China. OEMs (Original Equipment Manufacturers) have become a common concept, with global companies minimizing production and instead ordering traction machines, electrical cabinets, etc., from giant auxiliary manufacturers in China.

If you work in the industry and visit traction machine factories, electrical cabinet factories, rail factories, cable factories in China like Torin, KDS, Mona, Monarch, STEP, Marazzi, Savera, Wuxi Tongyong, Tianjin Gaosheng, you will see traction machines from one famous brand in one corner and rails from another famous brand in another corner…

That’s globalization. They are not wrong; the issue is that our perceptions and demands are no longer suitable for the times, so they are deemed to be ‘deceptive.’ Meanwhile, we casually use an iPhone (made in the US) manufactured 100% in China without any second thought.

But more dangerously, these perceptions are drowning out the opportunities and potential for Vietnamese businesses.

For the Vietnamese elevator industry to develop, it is crucial to have the support of a local ecosystem of supporting businesses.

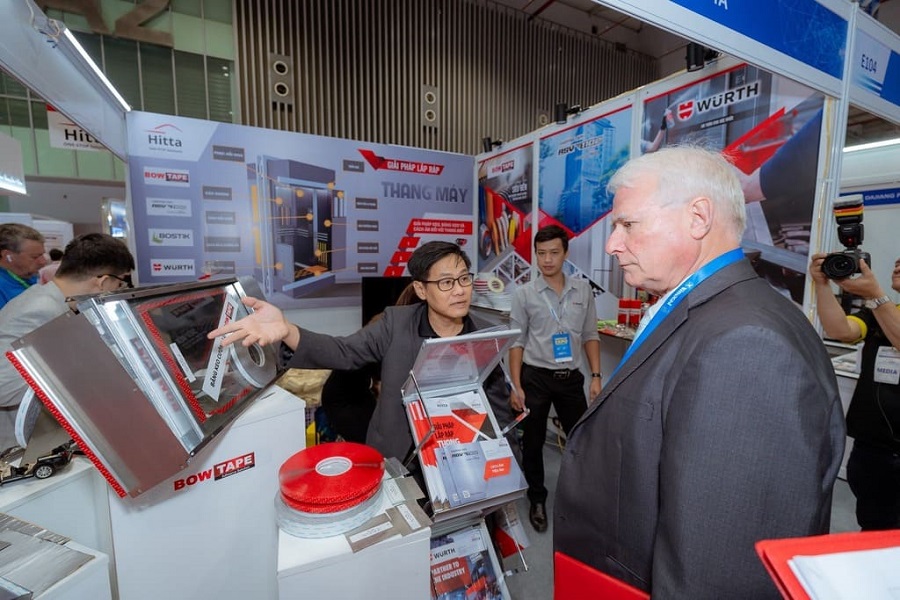

(Image: The Vietnam Elevator Expo 2023 exhibition held in Ho Chi Minh City)

Purchasing demands often require fully imported elevators, yet many are unaware that elevator companies, including those in Europe, are currently engaged in similar practices to Vietnamese businesses: manufacturing some components and purchasing others to assemble complete elevators. Impulse buying prevails, while technical standards and testing are rarely mentioned…

Thus, the substantial public investment budget, which ideally should stimulate domestic production and business growth, ironically benefits Vietnam only through the meager wages of installation and maintenance workers.

Whether this issue lies in awareness or other motivations of procurement officials perhaps needs further discussion in various forums.

Individual consumers, being practical, accept domestically assembled products but demand traction machines, control cabinets, etc., to be produced in G7 countries or some “more trustworthy than China.” This complicates matters for both consumers and Vietnamese businesses. They must accept purchasing products passing through “trusted” countries at higher costs, thus pushing Vietnamese businesses into tasks they ‘don’t want to do.’

However, under market pressure and for survival, businesses eventually cater to customers’ preferences by affixing “trusted” origins to their products. This addresses consumers’ psychological concerns and businesses’ survival needs. Yet, a significant portion of our foreign currency flows to countries with “trusted” reputations, without any real increase in product quality.

But if we continue like this, where will we end up, and what will become of Vietnamese business brands, always having to ‘seek refuge’ like this?

The issue is no longer old, but it’s urgent, very pressing. Perhaps we need more than just calls for ‘business ethics,’ appeals for the spirit of ‘Vietnamese people using Vietnamese products,’ or calls for the government’s role in providing support…

First and foremost, it’s time for the Vietnam Elevator Association to gather Vietnamese businesses to publish the industry’s ‘white paper’ so that everyone can understand and collectively break free from this perception ‘quagmire’.

Source: Tapchithangmay.vn